Boeing Co. is in discussions to acquire Spirit AeroSystems Holdings Inc., a move that would reclaim control of its struggling former aerostructures unit and the main supplier at the center of numerous quality issues affecting the 737 Max airliner.

“We believe that the reintegration of Boeing and Spirit AeroSystems’ manufacturing operations would further strengthen aviation safety, improve quality and serve the interests of our customers, employees and shareholders,” Boeing said Friday in a statement.

Buying back Spirit, which Boeing spun off in 2005, would mark the most dramatic step yet by the US planemaker to stabilize its supply chain after a series of damaging production faults. The latest and most serious lapse occurred early in January when a 737 Max 9 model lost a large fuselage panel during flight. While Spirit built the airframe in question, Boeing has said ultimate responsibility for safety and the right production protocols reside with the planemaker.

Spirit issued a separate statement confirming the talks, which were reported earlier by the Wall Street Journal and Bloomberg.

Shares of Spirit rose 2.2% in postmarket trading following a 15% jump in the regular session, giving it a market value of about $3.8 billion. Boeing fell 1.8% Friday and is down about 23% this year, the worst performer on the Dow Jones Industrial Average.

Wichita, Kansas-based Spirit is separately exploring the sale of a business in Northern Ireland that makes wings for Airbus SE, according to people familiar with the matter, who asked not to be identified because the talks are confidential. The European planemaker has held preliminary discussions with the supplier about buying the business, the people said.

Selling its Wichita operations to Boeing would be a “coup” for troubled Spirit, and give the planemaker a chance to fix the problems that have plagued its key supplier, Vertical Research Partners analyst Rob Stallard said in a client note. But the merger would provide an added distraction as the companies work to bolster quality controls and safety culture under intense scrutiny from regulators.

“Integrating Spirit would add additional pressure onto the Boeing Commercial Aircraft management team, while the Boeing balance sheet could do without the cost” of acquiring the company, Stallard said.

After Spirit was split off from Boeing, the company was sold to private equity investors, ending almost 80 years within the US planemaker’s fold. The move was part of Boeing’s drive to shed assets and ultimately become more profitable.

But the disposal left the contractor without the protective cover of Boeing’s balance sheet — particularly when the company faced a major crisis like the pandemic. During its 2020 nadir, Spirit cut 6,800 employees and put salaried workers on a four-day work week to preserve cash.

The supplier is now run by Pat Shanahan, a former Boeing executive, in a sign that the two companies are working more closely together. Last year, Spirit restructured key contracts with Boeing, still its biggest customer, to help bolster its ailing finances.

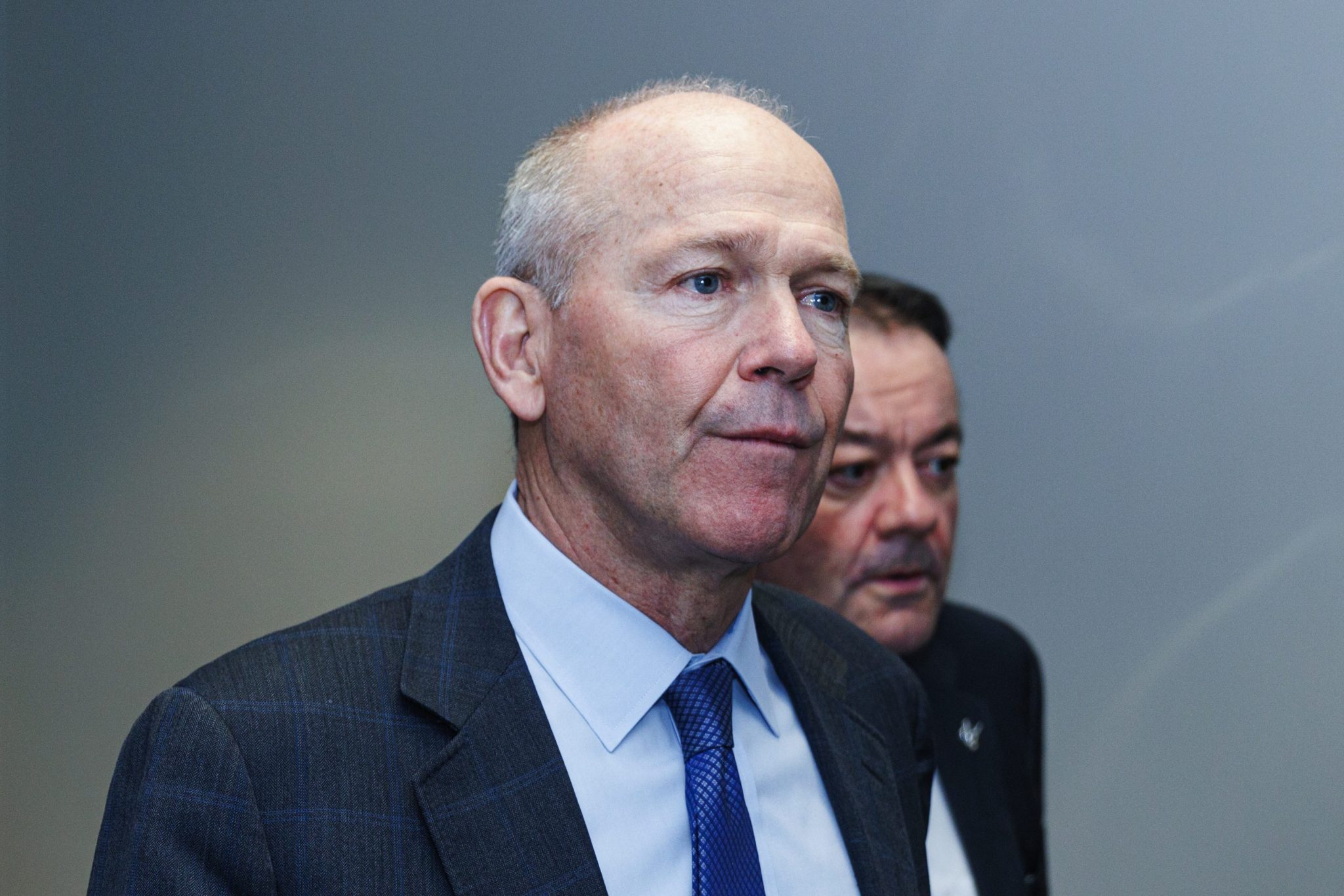

When asked if Boeing had gone too far selling off assets in past years, Boeing Chief Executive Officer Dave Calhoun told CNBC in January that “yeah, it probably did. But now it’s here and now. And now, I’ve got to deal with it.”

Until Boeing provided a cash infusion and restructured Spirit’s contract terms, the company had faced years of losses on a contract to build the nose-cone of the US planemaker’s 787 Dreamliner jets. Spirit has also been in contract talks with Airbus aimed at stemming its losses from the A220 and A350 programs.

Wing Factory

Airbus has also moved some suppliers of its airplane structures back in-house. Boeing is Spirit’s largest customer, accounting for 64% of the supplier’s revenue last year. Airbus was its second-largest with 19%. Spirit makes parts across the European planemaker’s product line, including wings for the A220 narrowbody at the Belfast plant it purchased from Bombardier Inc. in 2020.

Boeing and Spirit have faced withering scrutiny over quality control, particularly after the Jan. 5 accident. Spirit assembles most of the 737 Max plane’s fuselage before shipping them by rail to Boeing’s factory in Renton, Washington, for final assembly of the aircraft.

US investigators have said the so-called door plug on the plane involved in the accident was apparently missing four key retention bolts meant to hold it in place when it was handed over to the customer.

The incident capped a series of quality lapses involving Boeing’s former aerostructures unit. A drilling mishap on an aft pressure bulkhead supplied by Spirit slowed deliveries of the 737 Max last year, the planemaker’s most important generator of cash flow. A separate issue with tail-fin fittings also affected output earlier in 2023.

— With assistance from Siddharth Vikram Philip, Brooke Sutherland, and Catherine Larkin